On the Street Monthly – AI Arms Race Keeps Market Afloat

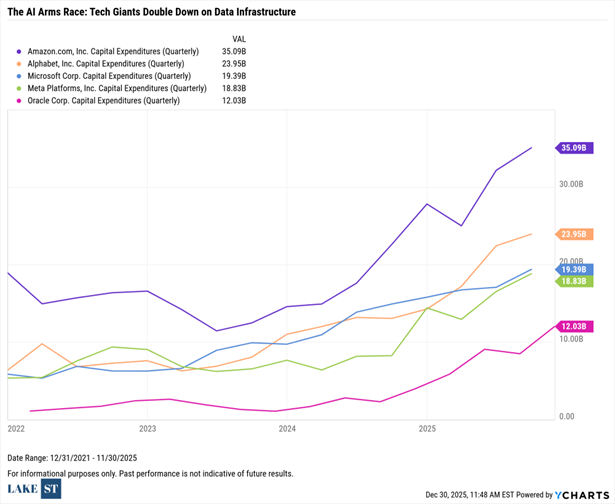

While 2025 has been marked by plenty of ups and downs, one of the most important developments has been the massive investment technology companies are making in artificial intelligence. In the third quarter alone, leading firms spent more than $100 billion building AI infrastructure, helping support overall market performance.

(Source: Y-Charts)

Nvidia has grown its quarterly data center revenue alone to over $51.22 billion. The next phase for investors will be determining when these investments start to pay off. So far, optimism has been fueled by both the scale of spending and patience around future returns but longer-term market gains will depend on turning that investment into meaningful outcomes.

International Stocks Shine

International stocks entered 2025 having lagged U.S. equities by a wide margin. In October 2024, The Economist featured a cover depicting the U.S. dollar blasting off into space which was a reflection of dollar strength at the time. For U.S.-based investors, allocating overseas introduces a second return driver: currency movements.

(Source: Y-Charts)

Since that cover was published, the U.S. dollar has declined 5.27%, while international stocks have gained 21.33%. While multiple factors have contributed to this performance, the inverse relationship between the dollar and international equities has been notable. It is a dynamic worth monitoring into 2026, particularly as diversified portfolios with international exposure have benefited meaningfully in 2025.

Midterm Election Years

With 2026 being a midterm election year, we reviewed historical patterns in S&P 500 performance both leading up to and following midterm elections. The chart below compares S&P 500 returns during midterm election years to the average performance of the other three years in the election cycle.

(Source: Capital Group)

While midterm years have historically delivered lower overall returns than the average of the other three years combined, the timing of those returns is notable. Performance leading up to the early November election tends to be muted, with the majority of gains occurring late in the year. Volatility has also been meaningfully higher during midterm years relative to the rest of the cycle. Aside from the brief spike surrounding the Liberation Day tariff announcement, market volatility in 2025 has remained relatively subdued. Historically, we would not be surprised to see volatility increase more materially in 2026.

Articles We’re Reading

Nvidia takes $5 billion stake in Intel under September agreement (CNBC)

Pending home sales jump by most since February 2023 in November (Yahoo Finance)

Venture Capital firms are again saying 2026 will be key year for AI enterprise adoption ramp (TechCrunch)

Forecasters see little hiring growth in 2026 as firms lean on technology to take on more tasks (MSN)

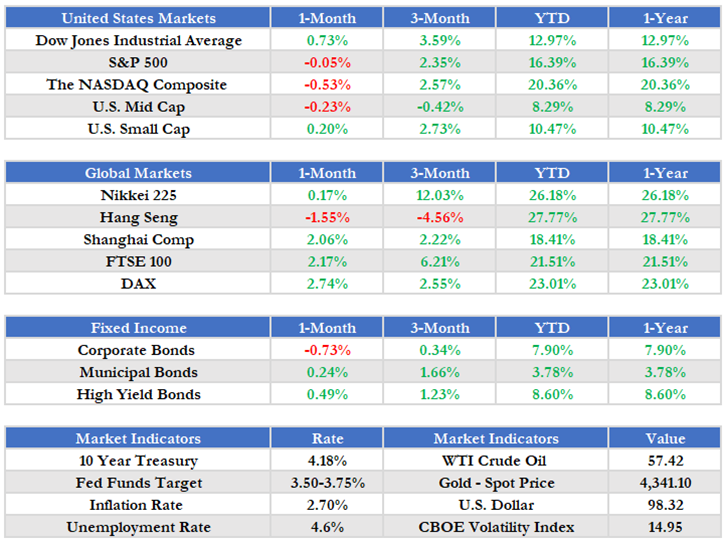

Market Snapshot

For the Month Ending 12/31/2025 (Cumulative Returns)1

1Source – Morningstar, Inc. Corporate Bonds is presented as the iShares iBoxx $ Investment Grade Corporate Bond ETF. Municipal Bonds is presented as the iShares National Municipal Bond ETF. High Yield Bonds is presented as the iShares iBoxx $ High Yield Corporate Bond ETF. 10 Year Treasury refers to the valuation of a 10 Year Treasury Note, a debt obligation issued by the U.S. Department of the Treasury. Fed Funds Target represents upper limit of the federal funds target range established by the Federal Open Market Committee. Inflation Rate provided for the purposes of this report by the U.S. Bureau of Labor Statistics. Unemployment Rate calculated by the U.S. Bureau of Labor Statistics. WTI Crude Oil refers to the price of a barrel of West Texas Intermediate NYMEX) Crude Oil. Gold – Spot Price relates to the valuation of an ounce of gold, as traded on the NYSE Arca Exchange. U.S. Dollar refers to the U.S. Dollar Index (DXY). All Returns are denominated in USD (United States Dollar), unless otherwise explicitly noted.

Did You Know?

The iconic New Year’s Eve ball drop in Times Square began in 1907 after fireworks were banned in New York City. To keep the celebration alive, The New York Times introduced a time ball inspired by maritime signals used in ports. The original ball weighed 700 pounds and was lit by 100 bulbs. More than a century later, the tradition continues marking a shared moment of celebration for millions around the world.

Presented by the Investment Committee of Lake Street, an SEC Registered Investment Adviser

The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Diversification does not ensure a profit or guarantee against a loss. There is no assurance that any investment strategy will be successful. Investing involves risk and you may incur a profit or a loss.